GIF from GIPHY

The fact that it is such a foreign concept also made me think of the worst that can happen, and I sure as hell didn’t want to end up bankrupt from uninformed investment choices at such a young age.

GIF from GIPHY

The fact that it is such a foreign concept also made me think of the worst that can happen, and I sure as hell didn’t want to end up bankrupt from uninformed investment choices at such a young age.

So How Did People Actually Get Into It?

Curious to see how some of my peers got started in their foray, I checked in with two of my friends who’ve invested in some stocks since their early twenties. Exactly like how many of us who haven’t started investing would feel, the main struggle that 26-year-old Daniel faced when he started investing at 20 is finding the initial courage to do it. Fortunately for him, a degree in finance and capital from a father who is quite an avid investor gave him a head start. For the rest of us who aren’t that lucky in that sense, it’s hard to start because we don’t even know what we don’t know - which is pretty much the most helpless state one could be in. GIF from GIPHY

However, like what DollarsAndSense.sg wrote in an article about investing with just $100 a month in Singapore, “Setting aside a large sum of money and acquiring extensive knowledge before you actually start investing is not only unnecessary and impractical, it may not even be the ideal situation.”

As for 26-year-old Billy who paid to learn from investment courses, his challenges were figuring out what stocks to buy and which platform to use when he first got started at 22. And it was a nerve-wrecking process of trial and error before he got the hang of things.

Even for Daniel and Billy today, they still find themselves lacking time to monitor their investments.

That’s where technology like the new robo-investing service comes in.

GIF from GIPHY

However, like what DollarsAndSense.sg wrote in an article about investing with just $100 a month in Singapore, “Setting aside a large sum of money and acquiring extensive knowledge before you actually start investing is not only unnecessary and impractical, it may not even be the ideal situation.”

As for 26-year-old Billy who paid to learn from investment courses, his challenges were figuring out what stocks to buy and which platform to use when he first got started at 22. And it was a nerve-wrecking process of trial and error before he got the hang of things.

Even for Daniel and Billy today, they still find themselves lacking time to monitor their investments.

That’s where technology like the new robo-investing service comes in.

A Gem For Beginners And The Time-Starved

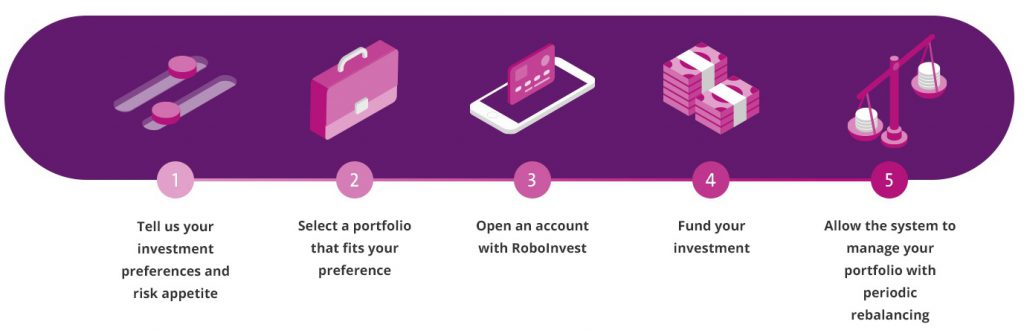

As the name suggests, robo-investing works like a virtual consultant and is basically an online investment advisor that uses algorithm to monitor your investing portfolio. The automated digital investment platform will help match your needs and preferences to portfolios best suited for you. In other words, your ‘digital assistant’ will recommend portfolios to you so you can get the best possible returns. One such robo-investing service available in Singapore is OCBC RoboInvest. Whether you’re new to investing or want to invest but are too busy to do so, OCBC RoboInvest helps you invest and grow your savings with minimum effort. The first of its kind offered by a bank in Singapore, it’s an investment platform that lets you choose your preferred portfolio and uses algorithms to track and rebalance your investment portfolios, with your approval.