GIF from GIPHY

The fact that it is such a foreign concept also made me think of the worst that can happen, and I sure as hell didn’t want to end up bankrupt from uninformed investment choices at such a young age.

GIF from GIPHY

The fact that it is such a foreign concept also made me think of the worst that can happen, and I sure as hell didn’t want to end up bankrupt from uninformed investment choices at such a young age.

So How Did People Actually Get Into It?

Curious to see how some of my peers got started in their foray, I checked in with two of my friends who’ve invested in some stocks since their early twenties. Exactly like how many of us who haven’t started investing would feel, the main struggle that 26-year-old Daniel faced when he started investing at 20 is finding the initial courage to do it. Fortunately for him, a degree in finance and capital from a father who is quite an avid investor gave him a head start. For the rest of us who aren’t that lucky in that sense, it’s hard to start because we don’t even know what we don’t know - which is pretty much the most helpless state one could be in. GIF from GIPHY

However, like what DollarsAndSense.sg wrote in an article about investing with just $100 a month in Singapore, “Setting aside a large sum of money and acquiring extensive knowledge before you actually start investing is not only unnecessary and impractical, it may not even be the ideal situation.”

As for 26-year-old Billy who paid to learn from investment courses, his challenges were figuring out what stocks to buy and which platform to use when he first got started at 22. And it was a nerve-wrecking process of trial and error before he got the hang of things.

Even for Daniel and Billy today, they still find themselves lacking time to monitor their investments.

That’s where technology like the new robo-investing service comes in.

GIF from GIPHY

However, like what DollarsAndSense.sg wrote in an article about investing with just $100 a month in Singapore, “Setting aside a large sum of money and acquiring extensive knowledge before you actually start investing is not only unnecessary and impractical, it may not even be the ideal situation.”

As for 26-year-old Billy who paid to learn from investment courses, his challenges were figuring out what stocks to buy and which platform to use when he first got started at 22. And it was a nerve-wrecking process of trial and error before he got the hang of things.

Even for Daniel and Billy today, they still find themselves lacking time to monitor their investments.

That’s where technology like the new robo-investing service comes in.

A Gem For Beginners And The Time-Starved

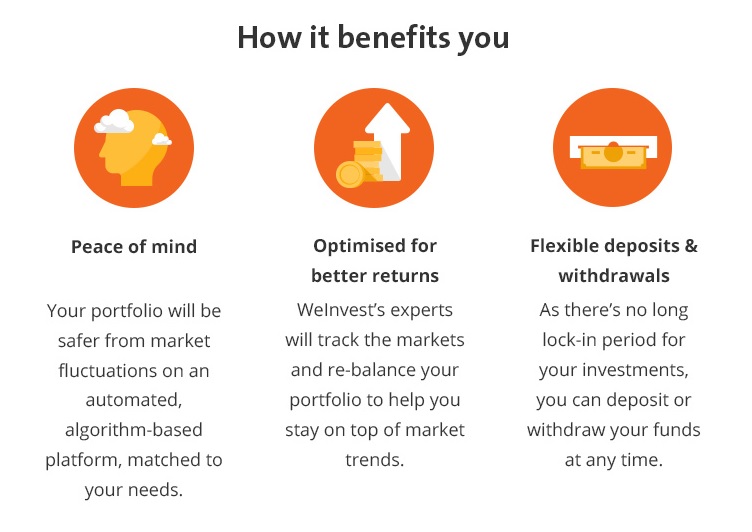

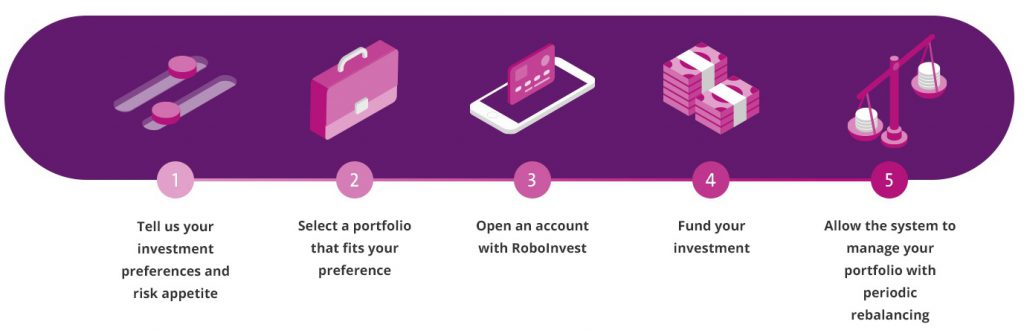

As the name suggests, robo-investing works like a virtual consultant and is basically an online investment advisor that uses algorithm to monitor your investing portfolio. The automated digital investment platform will help match your needs and preferences to portfolios best suited for you. In other words, your ‘digital assistant’ will recommend portfolios to you so you can get the best possible returns. One such robo-investing service available in Singapore is OCBC RoboInvest. Whether you’re new to investing or want to invest but are too busy to do so, OCBC RoboInvest helps you invest and grow your savings with minimum effort. The first of its kind offered by a bank in Singapore, it’s an investment platform that lets you choose your preferred portfolio and uses algorithms to track and rebalance your investment portfolios, with your approval.

Shaan, 20

“I’ve never bought insurance for myself before but I know I’m still under a plan that my parents bought for me. I intend to get one myself once I start working. I get the general idea that it’s to protect my life but I don’t really know what kinds of insurance are there and what I need.”

Pro-tip on what to look out for as beginners:

There are several things to know before buying a plan: the policy term, sum assured, and hospital preferences. You can also ‘customise’ your policy by adding riders – which are additional options to cover you in more areas on top of the ‘default’ plans offered. If you’re concerned about your finances, there are also different ways you can pay your policy premiums. Opt to pay your premiums at one go (lump sum payment), or break them up into annual or monthly instalments if you need to ‘spread out the damage’. Above all, don’t be afraid to ask insurance agents questions. It’s more important for you to know what you’re buying than be worried about them getting annoyed. Still not sure what you need exactly? Set up an appointment with FRANK by OCBC here!Marc, 25

“My parents bought some sort of family package for us so I believe I’m covered under that package in terms of life insurance or any accidents. So instead of buying any other insurance for myself, I spend that amount investing instead.”

Pro-tip on knowing the different types of insurance coverage:

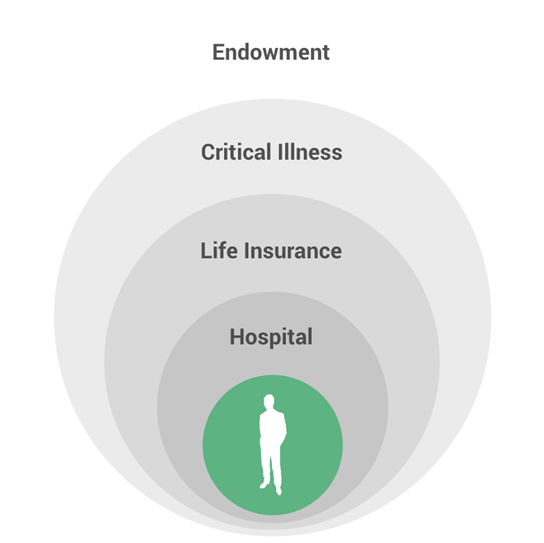

In case anything happens to you, you’d want to find out how much you are covered for under policies your parents bought, and to review the sum based on life stages. Also, did you know that it takes more than one layer of insurance for you to be fully protected? The four main layers of protection are Hospital, Life Insurance, Critical Illness, and Endowment.

Brenda, 26

“I’m not very sure what I got. I just know that I’m covered for certain terminal or critical illnesses and death. Also, I’ll get a lump sum when my policy matures at 55 years old. This is the only plan I bought as I think it’s good enough – it covers my health and also gives me some money back when I’m old.”

Pro-tip on Endowment VS Savings VS Life Insurance Plans:

What Brenda described is an Endowment Insurance Plan, which helps to grow your wealth while providing you basic insurance coverage. The returns you get may not be as high as stocks and shares, but Endowment Insurance Plans are less risky and give you better returns than a deposit account with a bank. There’s a difference between a Savings Plan and an Endowment Insurance Plan too. Where Endowment Plans give you coverage on certain things like critical illnesses or death, Savings Plan don’t. Then there are Life Insurance plans, which are designed to not just help you, but also your family. Should you happen to pass away, get diagnosed with a terminal illness, or have a total permanent disability, a Life Insurance Plan will grant you (or your beneficiary) a sum of money that will help greatly in that time of need. You can find more information here.Esther, 25

“I have three insurance plans: Life Insurance, Hospitalisation, and Endowment. The Life Insurance Plan is to help "protect" my loved ones (children, spouse) financially should anything happen to me. Like if I die, they get a sum of money. I got the Hospitalisation Plan to cover me up to A Class government hospital. And for Endowment, it's more of a savings plan that my husband and I bought so that we can get a certain percentage of return after 18 years.”

Pro-tip on Life Insurance VS Hospitalisation VS Endowment Plans:

You can never be too sure when it comes to health, so it’s important to be fully aware of what kind of coverage you get under different insurance plans. Hospital bills can add up to a hefty amount and a Hospitalisation Plan helps cover the expenses for treatments and staying in hospital wards. Note that there are limitations though. Treatments for certain critical illnesses may not be covered under the Hospitalisation Plans, which is where Critical Illness Plans come in. A Critical Illness Plan will cover the expensive treatments for illnesses like stroke and cancer. Learn more about the differences in Hospitalisation, Life Insurance, and Critical Illness plans here.Plan Your Future Wisely

As a millennial, I fully understand the pain of paying a few hundred dollars a month on something that doesn’t give you immediate gratification. But from another perspective, you’re actually diligently saving this amount in a bank every month – a bank that will actually help you in times of need in the future. Learn more about the different types of insurance and how it covers you differently at FRANK by OCBC.Enjoy Special Promotions (Till 31 Dec)

Whether you’re a first time insurance buyer, or looking to get another layer of protection for your life, here are three promotions FRANK by OCBC is running till 31 December 2017:- Enjoy S$60 Cash Rebate when you purchase the Regular Premium Endowment Insurance –Annual Premium <S$4,999

- Enjoy S$30 Cash Rebate when you purchase the Regular Premium Endowment Insurance –Annual Premium, S$300 – S$799,

- Get S$100 cash credit when you buy 2 out of the 3 insurance below

- Hospital: Supreme Health

- Term Insurance: MaxTermValue CI

- Personal Accident: PA plan (PA Protect, PA Supreme, PA Cashback Plus, Great Protector)